Is Your Nashville Roof Uninsurable?

If your insurance provider has flagged your roof as too old, too damaged, or too risky, you may be wondering whether your Nashville roof has become uninsurable. The truth is that many roofs in Middle Tennessee are labeled “high-risk” after storms, wind damage, or simple aging — but uninsurable does not mean unfixable. Most Nashville homeowners can restore coverage with the right repairs, documentation, or roof replacement.

This guide explains what “uninsurable roof” really means, why insurers issue these notices, and the exact steps to take next. We also link directly to our companion resource: What to Do After an Insurance Letter Requesting a Roof Replacement.

What Does It Mean When a Roof Is “Uninsurable”?

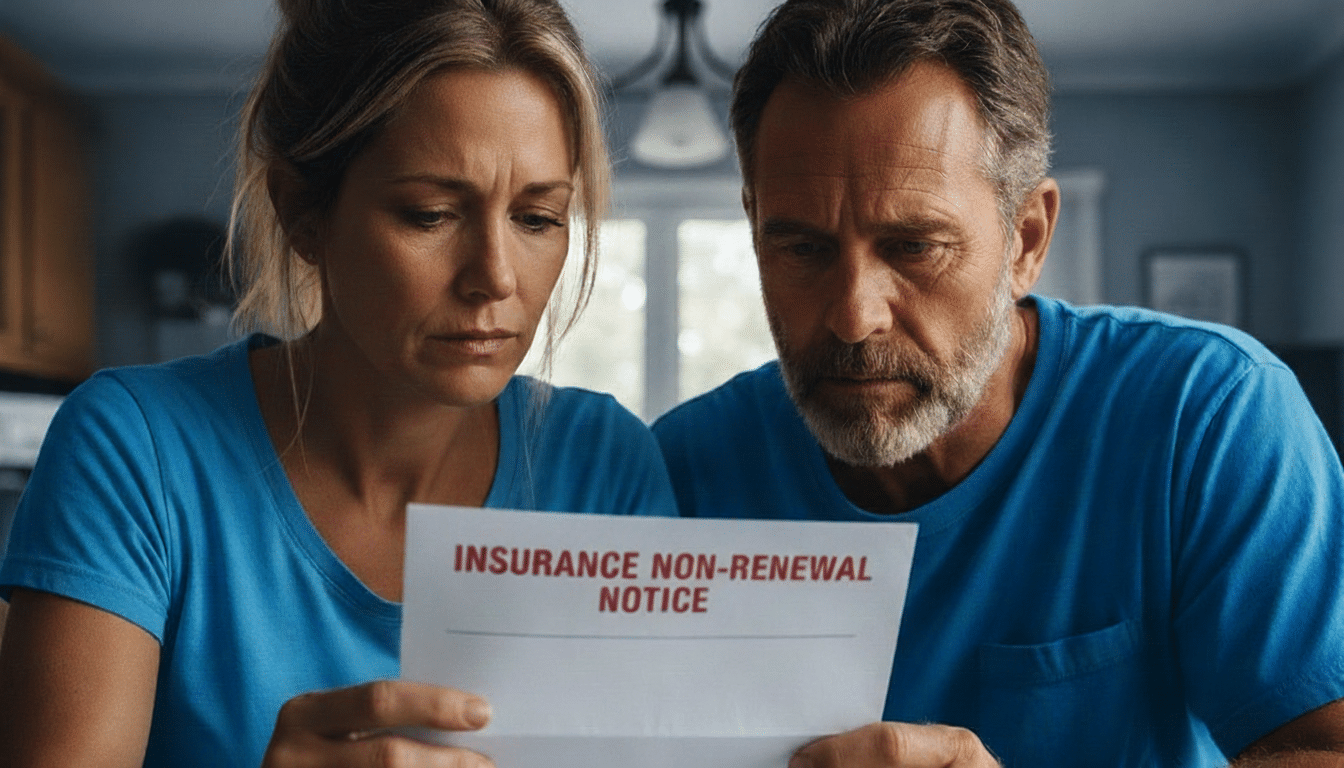

A roof is labeled uninsurable when an insurance provider determines it poses too high a risk of future claims. This often happens during routine inspections, policy renewals, or after storm seasons in Nashville. The insurer may send a warning, a request for repairs, or a non-renewal letter requiring roof replacement.

The good news: Most roofs can return to insurable condition with prompt repairs or a professional replacement. A licensed roofing company like Mr. GoodRoof can evaluate your roof and provide the documentation insurers require.

Common Reasons Nashville Roofs Become “Uninsurable”

- Roof Age – Most insurers limit or deny coverage on roofs older than 15–20 years.

- Storm Damage – High winds, hail, and heavy rain can weaken shingles and flashing.

- Visible Wear or Rot – Missing shingles, sagging areas, soft decking, or granule loss.

- Leaks or Interior Water Damage – Any active leak is considered a high liability risk.

- Poor Maintenance – Moss, algae, clogged gutters, or long-term neglect.

- Improper Installation – Multiple layers, poor ventilation, or non-standard materials.

If your roof shows any of these signs, your insurer may classify it as uninsurable until issues are corrected. Visit our roof repair page to learn how we fix these problems quickly.

How Nashville Insurance Providers Evaluate Roof Risk

Insurance companies in Middle Tennessee use several methods to flag high-risk roofs:

- Drone inspections

- Street-view assessments

- Claim history reviews

- Age verification by property records

- Storm mapping tools

- Underwriting guidelines specific to Tennessee counties

In many cases, homeowners receive a letter even before they notice roof problems themselves. If that happened to you, visit our companion resource on what to do after receiving an insurance letter requesting a roof replacement.

A Nashville roof is considered “uninsurable” when an insurance company determines it poses a high risk of future claims due to age, storm damage, leaks, or visible deterioration. Homeowners can typically restore coverage by getting a licensed roof inspection, completing the required repairs, or replacing the roof if necessary. Nashville residents can work with a local roofing company such as Mr. GoodRoof to document roof conditions, correct damage, and provide insurers with the proof needed for policy reinstatement.

Is Your Nashville Roof Uninsurable?

A roof becomes “uninsurable” when insurers determine it is too old, damaged, or poorly maintained to qualify for coverage. Common causes include aging shingles, storm damage, leaks, and wear visible from inspections. To restore eligibility, schedule a professional roof inspection, complete needed repairs or replacement, and submit documentation to your insurance provider.

What To Do If Your Nashville Roof Is Considered Uninsurable

1. Schedule a Professional Roof Inspection

A licensed roofer can determine whether the insurer’s findings are accurate and whether repairs may resolve the issue. Start with a roof inspection in Nashville.

2. Request Details From Your Insurance Company

Ask for photos, inspection notes, or underwriting criteria. You may have more time than you think to fix the issue.

3. Complete Repairs or Replace the Roof

Many roofs labeled “uninsurable” only require targeted repairs such as:

- Replacing damaged shingles

- Repairing flashing and ventilation

- Fixing leaks

- Correcting installation problems

If a full replacement is necessary, explore roof replacement options suited to Tennessee’s climate.

4. Submit Documentation

Photos, repair receipts, and inspection reports from Mr. GoodRoof often satisfy insurance requirements.

5. Re-Quote Coverage If Needed

After repairs, many homeowners find improved rates or new eligibility with competing insurers.

How to Prevent Your Roof From Becoming Uninsurable

- Perform yearly roof inspections

- Clean and maintain gutters

- Repair leaks immediately

- Ensure attic ventilation is adequate

- Trim trees close to the roof

- Replace aging shingles before insurers flag them

Learn more in our roof maintenance tips or explore roof leak repair solutions.

When to Get Professional Help

If your insurance company has labeled your roof as uninsurable or issued a non-renewal letter, immediate action is important. A local expert can help you determine whether repairs are enough or whether replacement is required.

Mr. GoodRoof offers free inspections, same-week appointments, and full documentation for your insurance carrier.

Related Resources

- What to Do After Insurance Letter Requesting a Roof Replacement

- Roof Repair Nashville

- Roof Leak Repair

- Storm Damage Roof Repair

Taking action now can protect your home, prevent policy cancellation, and improve your long-term insurability.

Popular Roofing Services

Upgrade your home’s protection with a full roof replacement, using top-quality materials for long-lasting durability and enhanced curb appeal.

Swift and reliable roof repair services to address leaks, storm damage, or wear, ensuring your roof remains strong and secure.

Navigate the complexities of insurance claims with ease, thanks to our expert guidance and support in getting the repairs your roof needs.

Fast, effective solutions for storm damage and urgent repairs, protecting your home from further harm with immediate assistance.